Explain the Different Sources of Finance of Redemption of Debentures

Companies use debentures when they need to borrow the money at a fixed rate of interest for its expansion. Redemption out of capital.

The debenture classification is.

. So let us take a look at the various methods of redemption of debentures. Debentures are issued by a company for acquiring long-term borrowings. Traditionally the Government issued bonds but these days bonds are also being issued by semi-government and non-governmental organisations.

Debentures and fixed deposits are two different ways of investing money through relatively low-risk financial instruments. From the proceeds of fresh issue of shares or debentures. These are also known as secured debentures.

Bond is also an instrument of acknowledgement of debt. I Debentures provide long-term funds to a company. There are a few ways in which this redemption of shares can take place.

Proceeds from the sale of real property plant and equipment. The holders of shares are the owners of the business. Sources of Redemption of Debentures.

They can be classified on the following basis. There are many ways to repay debts. Describe briefly the factors responsible for selecting a source of finance.

6 Sources of Finance for the Redemption of Debentures. Iii The interest on debentures is a tax-deductible expense and hence the effective cost of debentures. Redemption out of profits.

A redemption is the return of an investors principal in a fixed-income security such as a preferred stock or bond or the sale of units in a mutual fund. Issue and Redemption of Debentures 75 Bond. Redemption through the purchase of the debenture on the market.

1On the basis of Security. These are also issued to the general public. Images will be Uploaded soon Payment in Lump-Sum on the Debentures Maturity.

These debentures dont normally carry a particular rate of interest. For a clear understanding check a tabular representation. Under this category debentures can be subdivided into 2 types.

Specific Coupon Rate Debentures. A debenture is an unsecured. Sources of finance of the redemption of debentures are.

These may be of two types. Debentures are also known as a bond which serves as an IOU between issuers and purchaser. Each liquidation is different and will affect the final payout to a debenture holder.

Important Many investors may have the option to choose between a. This method as the name suggests is a one-time payment method. The amount required for redemption may be arranged.

Out of capital that is a redemption of debentures without the utilisation of any profits of the company. These methods all have different accounting treatment as well. An organisation is legally entitled to repay the principal amount to their debenture holders before the redemption date.

Ii The rate of interest payable on debentures is usually lower than the rate of dividend paid on shares. Explain in detail the types of debenture. These are issued to the general public.

Types of Debentures. The company has the following main advantages of using debentures and bonds as a source of finance. The company can purchase its own debentures at the cost of available funds.

Such debentures hold a particular date of redemption which is mentioned on the certificate. Secured and Unsecured Registered and Bearer Convertible and Non-Convertible First and Second are four types of Debentures. Redemption through the conversion of debentures into new debentures or equity shares.

In order to restore the investors such type of. From Coupon Rate Point of view. ASecured Debentures- Mortgaged Debentures are those debentures that are secured against assets of a company.

Newly issued equity or products of debt holders. Each method follows a unique billing method. Such debentures are circulated with a mentioned rate of interest and it is known as the coupon rate.

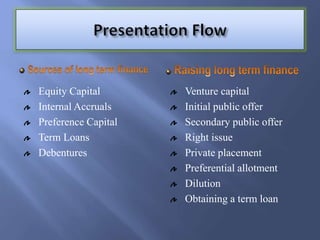

There are various types of debentures like redeemable irredeemableperpetual convertible non-convertible fully secured partly secured mortgage unsecured naked first mortgaged second mortgaged the bearer fixed floating rate coupon rate zero-coupon secured premium notes callable puttable etc. Sources of long term finance The main sources of long term finance are as follows. The proceeds from fresh issue of sharesdebentures.

Debenture Redemption Methods. Most debentures circulated by enterprises fall in this class. Differentiate between cumulative and non cumulative debentures.

Write a note on international sources of finance.

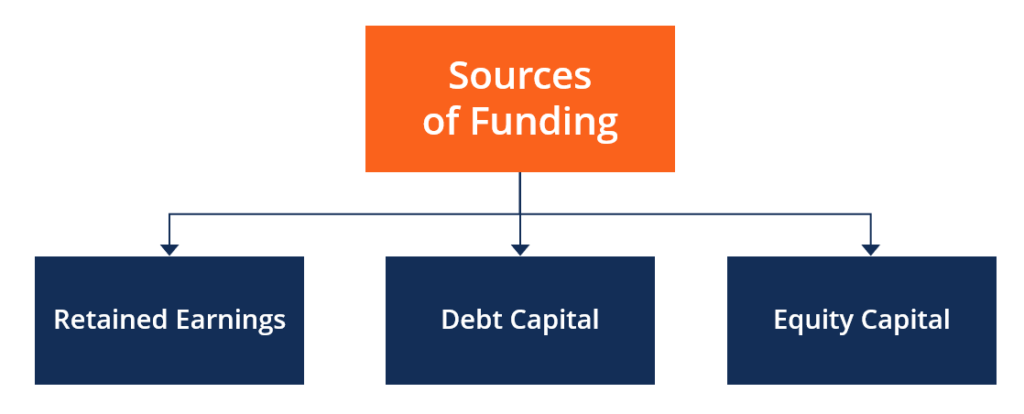

Sources Of Funding Overview Types And Examples

Business Finance Theory And Practice

Af 212 Financial Management Pdf Dividend Loans

What Are The Sources Of Business Finance Business Finance Finance Business

Sources Of Redemption Of Debentures Commerceiets

What Is Redemption Of Debentures Definition Methods Journal Entries Example The Investors Book

Acctg 235 Chapter 3 Sources Of Financing

Chapter 7 Sources Of Finance And Uses Ba364 Studocu

Redemption Of Debentures Methods Of Redemption Of Debentures

Sources Of Finance Owned Borrowed Long Short Term Internal External

6 Money Liquidity Credit And Debt In Monetary And Financial Statistics Manual And Compilation Guide

Sources Of Redemption Of Debentures Commerceiets

1 9 Financial Management 1 Notes Financial Management Study Notes Financial Interest Rate Pubhtml5

Tonex Training Courses Mergers And Acquisitions Training Financial Management Merger Train

Important Role Of Debentures As A Source Of Finance Assignment Point

Tonex Training Courses Mergers And Acquisitions Training Financial Management Merger Train

Comments

Post a Comment